Invoice Processing Platform (IPP) - Payment Amount does not Reflect Invoice Amount

The following outlines the process to obtain additional information if the invoice payment amount does not reflect the amount of the invoice.

Log into IPP at www.ipp.gov and select Collector (Supplier) module. Sign in using ID.me or Login.gov. The IPP Collector home page will display.

There are two valid reasons that could result in an invoice payment being a lesser amount than the original invoice submission:

- Discount was offered on the invoice.

- Offset was collected through the Treasury Offset Program.

Checking Payment Status

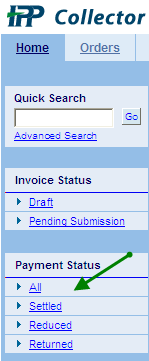

- Select All under Payment Status from the home page to display your payments for the last 120 days.

| Status | Definition |

|---|---|

| Settled | This indicates that an invoice has been paid |

| Reduced | This is a payment that was partially offset through the Treasury Offset Program. All federal payments are eligible for offset, including wage, salary, retirement, vendor, expense reimbursement, certain benefits, travel advances, grants, fees, tax refunds, judgments etc. |

| Returned | Payments listed as returned would be payments that have come back to us from the bank listed for ACH deposit due to the account was closed or the wrong account number etc. |

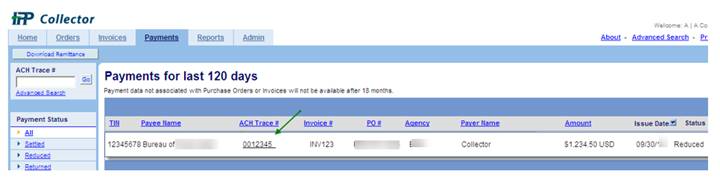

- Locate the invoice number and select the ACH Trace # link.

- EFT Check Image will display.

- If the Payment was reduced, the status will display Reduced.

Administrative Users have access to review offsets as a result of the Treasury Offset Program. The information is not available to our offices as the information is confidential.

Need Help?

Accounts Payable Help Desk

Monday - Friday (Except Federal Holidays)

7:00 AM - 6:00 PM EST

(304) 480 - 8000, Option 7

accountspayable@fiscal.treasury.gov

Return to the IPP Quick Reference Guide